Meaning of Earnest Money!

Earnest money simply funds the liquidated damages provision. If the buyer defaults, the seller is damaged. The seller had the property off the market during the pendency of the agreement, the seller made special arrangement in anticipation of closing, the seller made improvements to accommodate buyer, etc. Thus, when the buyer defaults, the seller is entitled to a remedy. In other words, an earnest money provision is a liquidated damages clause entitling the seller to the earnest money if the buyer defaults.

Earnest money simply funds the liquidated damages provision. If the buyer defaults, the seller is damaged. The seller had the property off the market during the pendency of the agreement, the seller made special arrangement in anticipation of closing, the seller made improvements to accommodate buyer, etc. Thus, when the buyer defaults, the seller is entitled to a remedy. In other words, an earnest money provision is a liquidated damages clause entitling the seller to the earnest money if the buyer defaults.

Before any document or agreement can become a legal and binding contract for both sides, seller and buyer, something must be offered as evidence and proof that an agreement is more than just a person’s word to buy the property. Earnest money is that negotiation tool and proof of commitment to the transaction. A buyer who puts down less earnest money could be signaling less commitment to the transaction. Thus, the more money you put down, the more motivation you are displaying to the seller that you indeed want to buy his home.

What is The Right Amount of Earnest Money?

There is no formula for calculating earnest money that can be applied to a transaction. The right amount of earnest money can only be determined in light of the terms of the transaction. All real estate transactions are individual circumstances and require different approaches. This is one of the many reasons you want to be professionally represented by ‘your real estate broker’ when it comes time to negotiate a contract. As a general rule of thumb, earnest money usually falls within 1.5 to 3% of the purchase price. That being said, buyers should be counseled to set earnest money in conformity with the competitiveness of the marketplace, and the competitiveness of the remaining terms of buyer’s offer. If the buyer is lowballing seller’s price, the buyer may want to increase the earnest money to make buyer’s offer more desirable, and to compel the seller to believe that the buyer fully intends to close the transaction. In a strong seller’s market, the buyer may want to increase earnest money to distinguish buyer’s offer from the expected competing offers. However, in a buyer’s market where the seller is grateful to receive an offer, the buyer may have no reason to put a large earnest money at risk. Therefore, the amount of earnest money is a negotiating tool in nearly every transaction and a case-by-case basis.

When Do I Need To Pay This?

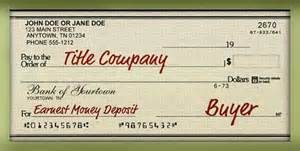

Earnest money is payable to the escrow company few days after mutual agreement.

What Happens To My Earnest Money And How Is It Used?

Earnest money will go into a trust account held by a third party (usually the escrow company trust account). This way, neither seller or buyer has access to it and it can be legally considered as earnest money to buy the property. Eventually, this money will be applied toward down payment and/or closing costs.

What Happens If Someone Defaults? Do I Get My Money Back?

This can be a very complex or complicated question to answer depending on the situation. Once again, here is why you need professional representation. While this question can become too deep to answer in a simple sentence, the general rule is that if a buyer backs out for no legitimate reason, the seller would get the earnest money. In other words, in the event of buyer’s default, the seller is entitled to retain the earnest money. On the other hand, if the seller backs out for no legitimate reason, then the buyer is refunded the earnest money in full.